404 – File or directory not steel cut oats recipe. The resource you are looking for might have been removed, had its name changed, or is temporarily unavailable.

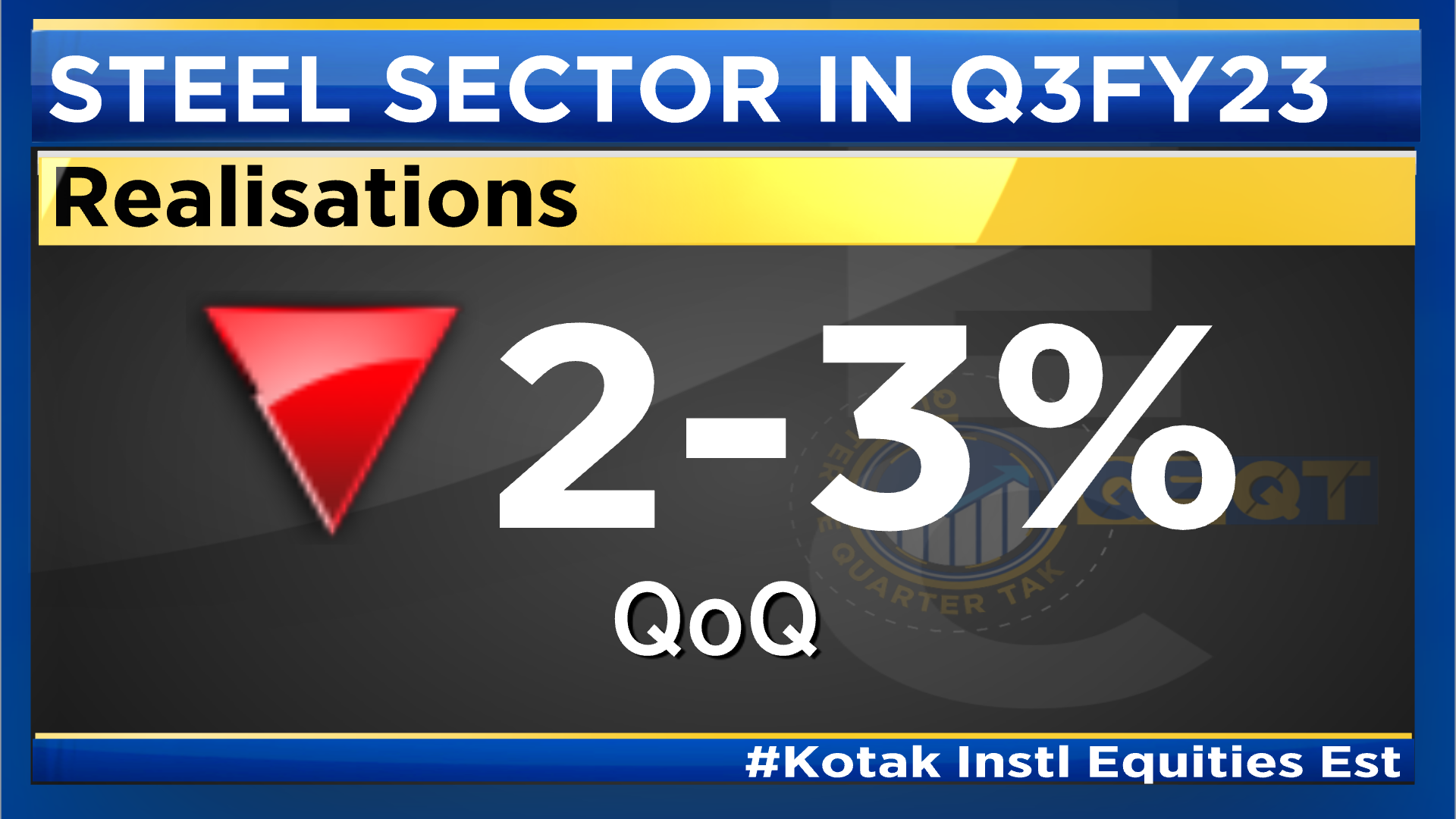

EBITDA per tonne for Tata Steel’s European business is likely to be a loss, due to a significant drop in prices and weak demand, resulting in an adverse product mix. After a disappointing few quarters, some sheen may return to India’s ferrous players, although they may not be glittery just yet. Steel sector earnings have fallen considerably after peaking in the September quarter last year due to a combination of weak demand, weak pricing and higher coking coal cost. The key takeaway from this quarter though, is that the companies may report better EBITDA per tonne after a gap of four quarters. For the December quarter, realisations for the overall industry are likely to decline by 2-3 percent compared to the previous quarter, which amounts to nearly Rs 1,500 per tonne. This will be due to price cuts and contract revisions during the quarter. A sequential cool off in raw material costs will aid non-integrated players to a larger extent.

Volumes for the industry may grow 13 percent from last year on a low base, despite exports being weak. Steel margins may recover by as much as Rs 4,000 per tonne during the quarter, but it will still be nearly half of the same period last year. On to the operating profit or EBITDA per tonne front, JSW Steel will delivery the biggest jump on a sequential basis, followed by SAIL, Tata Steel, and JSPL. As the operating profit of companies may fluctuate, lets take a look at the price-to-book ratios for companies to understand their valuation picture.